Fundamental Differences in Chinese online behaviours (Travel industry focused)

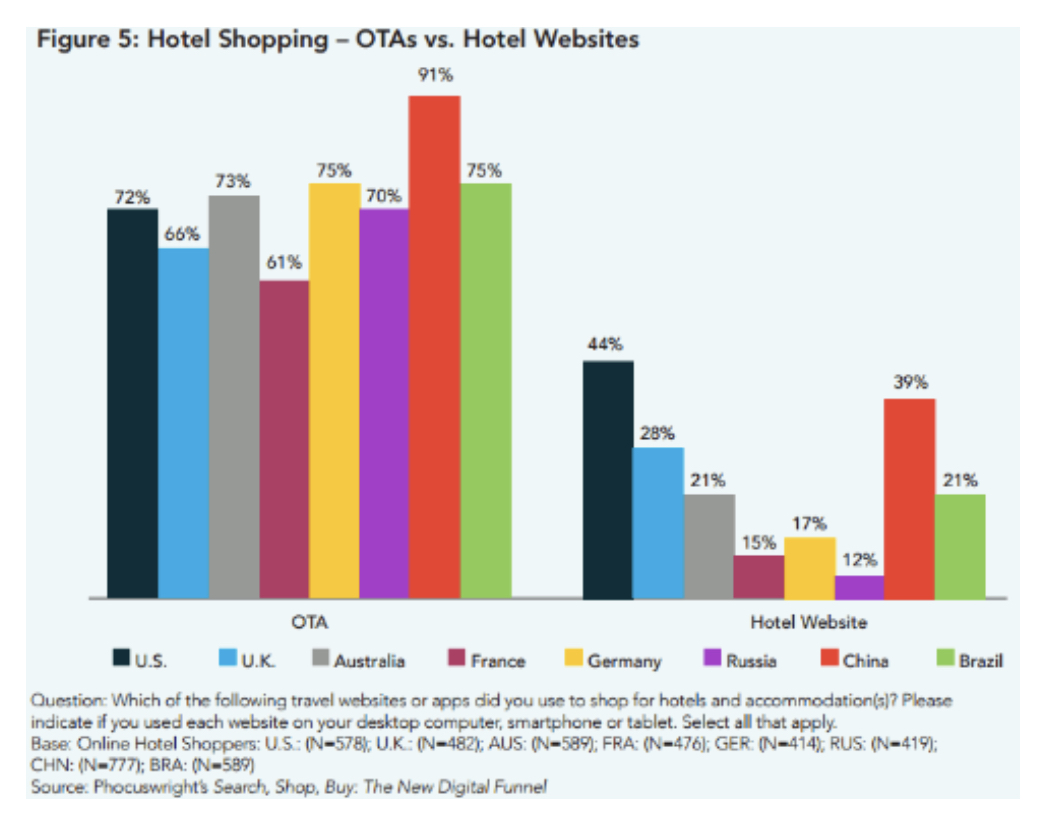

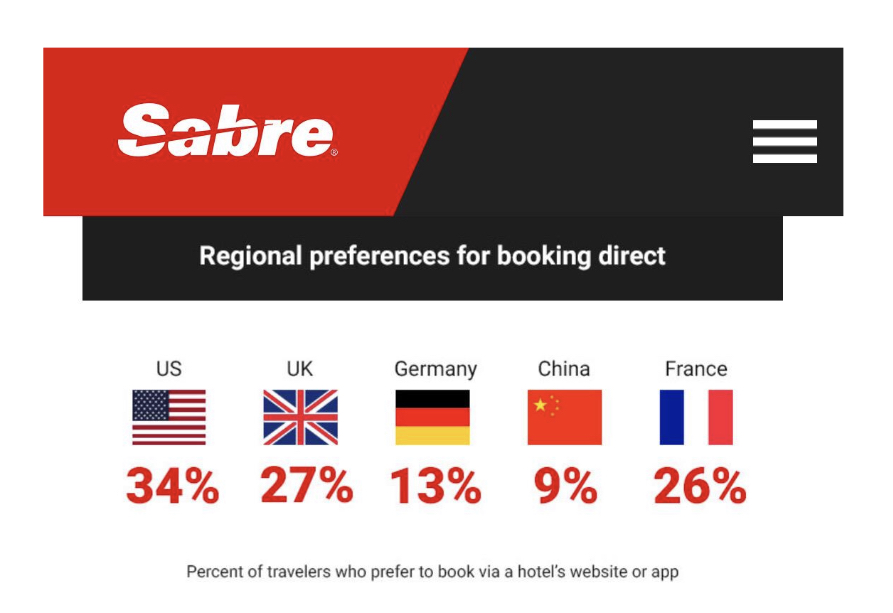

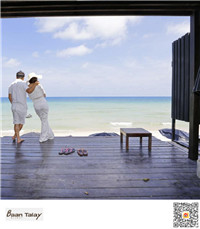

More than two years ago, I wrote the article “Major Misconceptions about getting Direct Hotel Bookings from China” . After me publishing this article, we got validation from trusting sources like PhocusWright and SABRE that stated 91% of Chinese prefers hotels shopping via OTAs and only 9% of Chinese may book direct.

But why is that? Other than the 3 pointers I mentioned in my 2018 article (which still hold true), I would like to provide additional 3 pointers in 2020 and go deeper to explain why. It may well go back to the fundamental differences in Chinese online behaviours.

1. Social commerce

As much as the social media landscape in the western world changes rapidly in these few years, say the rise of short-form videos, influencers marketing and to a certain extend social commerce (e.g. Instagram has a BUY button now), it is still far from what the China social commerce market is.

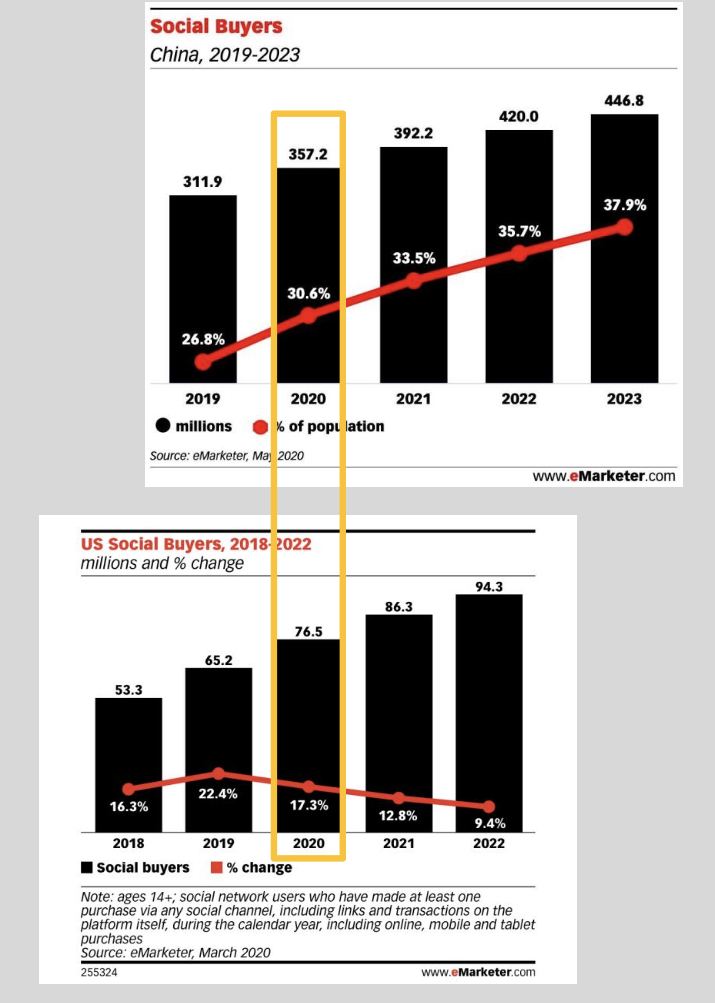

Take a look below. The absolute numbers (source: eMarketer.com) of social buyers in China in 2020 (357.2M) is about 4.67x of the social buyers in US (76.5M). And what’s more interesting from the eMarketer.com forecast is, it will continue to be an upward trend for social buyers in China to accelerate whereas it may be a downward trend for the US market.

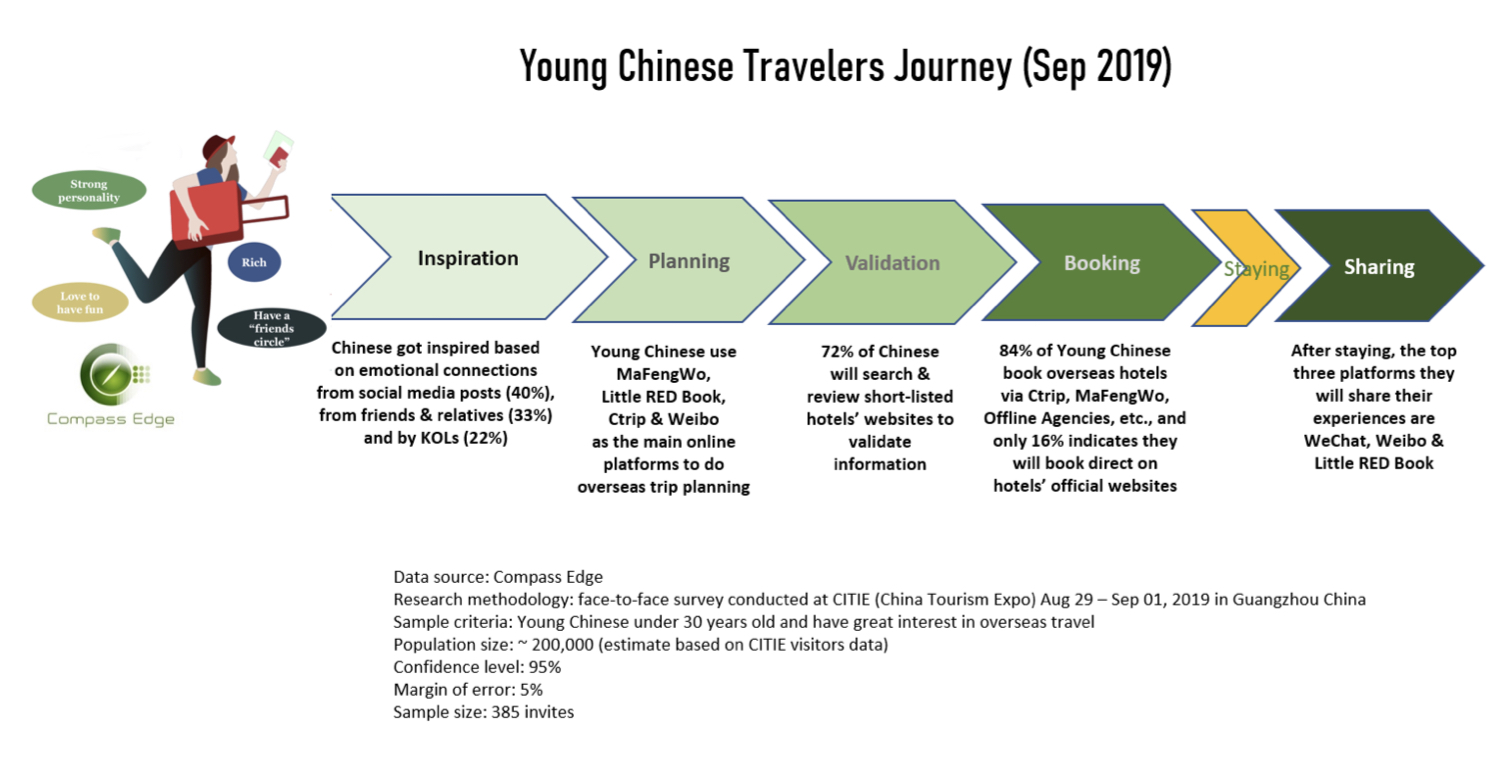

One key factor to contribute to such difference is Chinese online behaviour. For people from the west, Google or search is normally the first step in the consumers journey. But for Chinese, they DO NOT SEARCH for inspiration or in the discovery stage. In fact, Chinese use search engine as a research or validation tool for the specific brands they are interested in AFTER they got inspired on social media. Below is the Chinese Travelers Journey based on the survey we conducted.

Now, we see this behaviour not just coming from China’s upper tier cities but also from lower tier cities. There are interesting platforms like Pinduoduo – “together more savings more fun” social commerce model for new retail that penetrate well in lower tier cities. Hence, the digital social commerce trend will be fuelled from entire China. Since this is a travel industry focused article, I will not drift away too much. All I want to say is, if this is one fundamental online behaviour for all tiers, they will not change when they shop for travel. If you are not China social ready, you are not ready to have a piece in China social commerce.

2. Live streaming

Live streaming really takes off in 2020, a little “thanks” to COVID-19. Since people cannot travel, what do local Chinese tour guides do? Live streaming. What do hotels or attractions do to stay engaged with Chinese? Live streaming. What do OTAs and tourism board’s corporate leaders do to push promotions to Chinese? Yes, live streaming.

Live streaming is also trending in the west. You can do “live” easily on Facebook, Instagram, Twitter, LinkedIn, YouTube, etc. But why is it not creating the same buzz as it is in China? Again, it is due to the difference in Chinese online behaviours.

The “excitement” of live streaming in China is the opportunity to interact directly with the hosts real-time, whether it be the influencers you love and follow or corporate leaders that know their products best and can provide you with any detailed information you want. Remembered I talked about the trust issue in China before? Chinese will not only trust the content you put up online. Chinese buy from people they trust. Live streaming is a perfect way to build trusting relationships with the audience. And yes, China OTAs are building deeper relations with Chinese via live streaming.

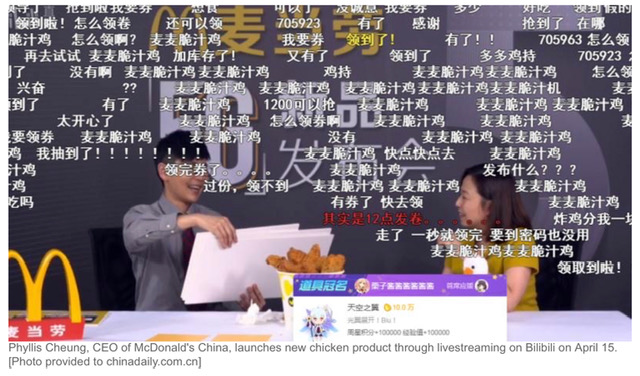

Next, the “excitement” of live streaming also comes from the limited quota, super deals Chinese can grab during the live streaming session. I will describe this as a gamification psychological behaviour as it is fun to interact with not just the hosts but even with other people that are on the same live streaming session. Below is a typical “bullet comments” screen shot on Bilibili. This is the power of social engagements and this is why we always said engagements are most real and important in China, not likes, not just followers.

3. Customer service expectations

Now due to the trust issue in China, there is always a tendency for Chinese consumers to bombard the brands with questions, before they make a purchase online. The massive number of consumers and their zest for questioning has created the need for chatbots in China. And WeChat, if you do not already know, is the origins of chatbots.

This contributes to another fundamental difference in Chinese online behaviours in customer service expectations. Although we all know bots cannot handle all types of customer requests, in China, somehow bots can interact with consumers quite seamlessly. Chinese do not mind to chat with bots as long as they can get responses simultaneously and sometimes maybe just an ear to hear their opinions.

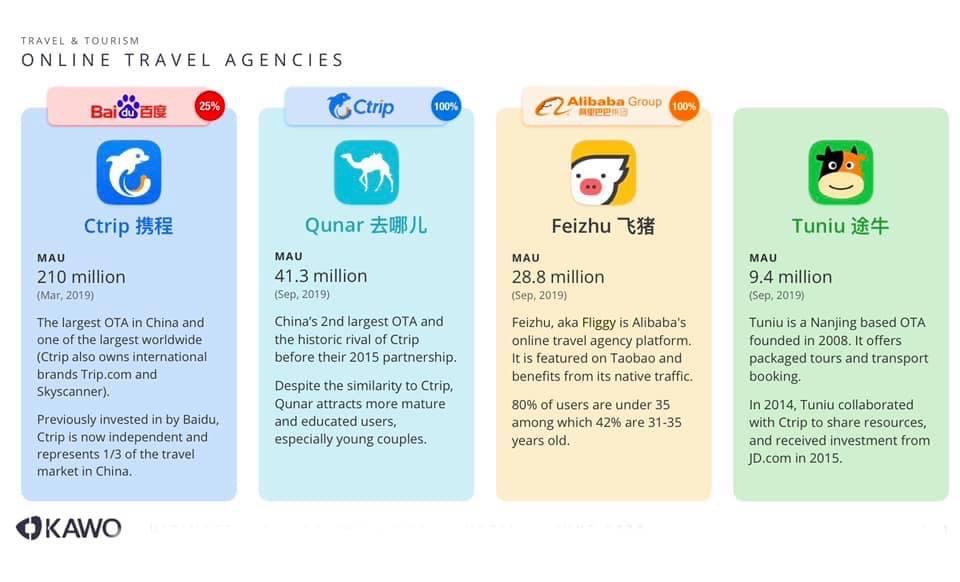

Now you can better understand why Chinese are so demanding so to speak especially in the online world as they are used to get replies right away. Of course, now you can expect China OTAs shown below (credit source: KAWO) such as Trip.com (Ctrip), Qunar, Fliggy, etc., are all using deep-learning chatbots to up their customer services. Hence, if you are serious about the China market, you need to be as responsive as you can be on the China social platforms with personalisation. There is no short cut for quick wins in China unfortunately.

Our industry got hit the worst in 2020 due to COVID-19 and we are all struggling, especially those of us who depends on China outbound tourism to rebound. However, COVID-19 expedites the above Chinese online behaviours. Do we sit back and do nothing? Not for me as only those who acted swiftly and decisively are likely to emerge stronger out of the COVID-19 crisis and not risk losing the linkage with this seemingly farfetched yet rewarding China market.

Tags: Chinese Online Behaviours; Social Commerce; Live Streaming; Chatbot; Hospitality Marketing; Chinese Outbound Tourism; China Social; Travel; Misconceptions

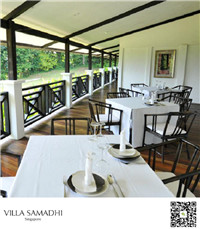

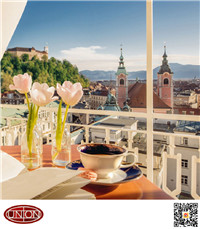

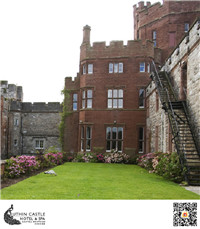

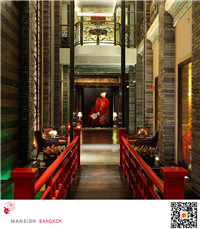

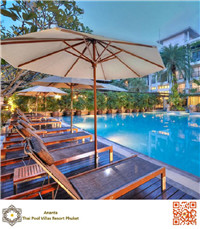

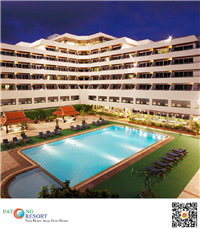

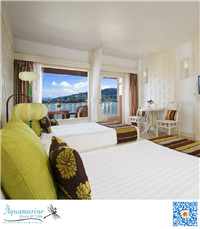

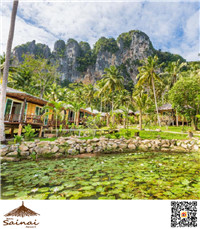

Compass Edge is a company offering online solutions to independent hotels. It is a niche service provider offering cost-effective branding solutions for overseas hotels to establish an online presence for the booming Chinese FIT market. It can also provide customers with an Internet Booking Engine, meta-search integration, GDS distribution and Channel Manager in its portfolio of solutions.

This article was written by Anita Chan, CEO of Compass Edge. Anita has extensive travel industry experience, and has worked all over the world with leading companies such as Four Seasons Hotels and Delta Hotels, as well as in corporate offices and technology service providers. Before joining Compass Edge, Anita worked as Regional Director for a leading OTA in Asia, as Global VP for a leading digital agency, and as VP Asia Pacific for Small Luxury Hotels of the World.