What Hotels GMs can do now to prepare for the return of Chinese travelers post COVID-19

In the webinar I was a guest presenter last week, I have shared a few post COVID-19 trends and shared my ideas on what hotels GMs can do now to get ahead of the game to welcome Chinese travelers post COVID-19. Happy to receive positive feedback that my suggestions are useful. I decide to elaborate on my ideas and write this article.

I have shared 4 trends post COVID-19 so I will quickly talk about these first to set the stage.

- Flexibility

This is what the world is expecting now. If you want someone to book now, it must be fully refundable. I believe the non-refundable discount rates strategy that we have implemented for years have to be thrown out of the window for the near future. Chinese will book discount rates but with no ties attached. So, it is time for GMs to rethink the rate strategy as booking habits will change post COVID-19.

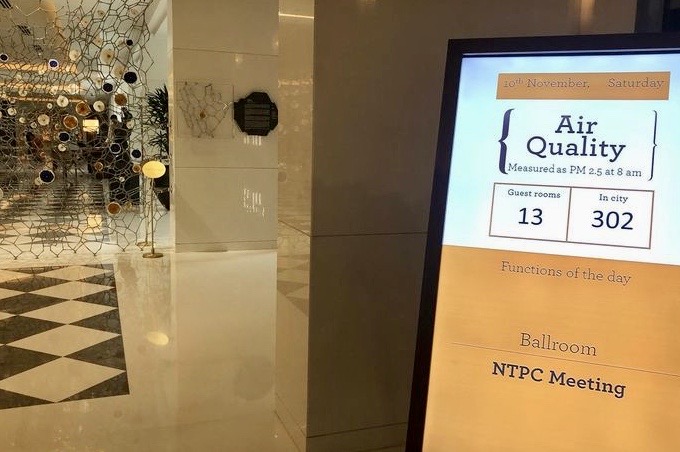

- Ambient Wellness

Safety is #1 consideration of Chinese travelers even before COVID-19. And now no matter what nationalities, we are all very cautious after hygiene. But in my mind, it is not just taking body temperature or giving out hand sanitizers or having a disinfectant schedule, etc. All hotels will do this. But to be ahead of the game, GMs need to rethink of all physical spaces to embed health-boosting measures into the very spaces that hotel guests pass through, making staying healthy effortless.

- Mental Wellbeing

I have talked about the sensitivity of Chinese travelers in my last article so I hope GMs can be a role model to help alleviate possible resistance between your front line staff and Chinese guests.

Here I am adding the peace-of-mind factor. Before COVID-19 cure is widely available, Chinese travelers would like to get assurance that even if they get sick, the medical system of the country the visited can support them and hotel they stayed can offer assistance if needed. Hence, GMs can prepare the checklist and procedure on “what if” so staff can be trained up now to handle potential crisis scenarios.

- Assisted Development

One outcome of more time spent at home? Many will be prompted, or forced (like me), to learn some life skills, such as cooking for themselves. Also mentioned in my last article, 49.3% Chinese females wish to “Live the Moment” post COVID-19 and will spend money now on what they believe is worth-while.

Chinese want to learn while traveling and be better versions of themselves. This is the new luxury. So hotels that can assist in their personal development will be the winners. I am not talking about just a cooking class or yoga class. I am talking about a deeper level. For example, text-the-chef to get cooking inspiration and tips. For example, a mediation program with set goals and challenges. As social distancing will continue for a while, private classes may be popular. It is an opportunity for GMs to rethink activities along this direction now.

Now getting into more specifics.

- A-commerce

Back in 2017/18, the increasing adoption of AI already drives A-commerce in China. Now, there is a sudden sharp increase for contact free interactions converging with advancement in robotics that is enabling a new breed of automated commerce.

In China, hotels are using robots for contactless room service delivery. Also, China is using automated UV light robots to disinfect public areas. Okay maybe it is not the best time to look at this type of investment now. But how about automate the check-in process so guests do not need to line up with strangers at the lobby? GMs can take this time to think about processes that can be automated using ready-technology. For Chinese guests, a lot of automation can be done using WeChat Mini Program.

- Create in-room dining experience

In the past, room service menu is only a fraction of the restaurant menu and it is merely created as a real dining experience. Post COVID-19, especially in the beginning, hotel guests may opt out of buffet breakfast. Many guests may want to order room service instead of eating outside or dining at the hotel restaurants. It is a good time for GMs now to consider ramping up room service menu to include famous local food items and to create / upgrade an unique in-room dining experience.

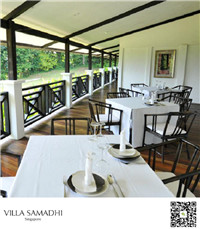

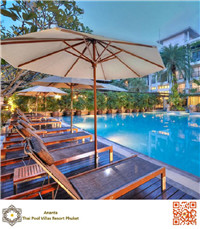

- Space arrangement

Just a quick point to mention that not only restaurant seating needs to be arranged to maintain the 1.5M safe distance. GMs can also look at beach chairs distance, conference rooms set-up, etc. And this may mean less covers, lower capacity for MICE or banquets too. A big question for GMs is how to make up lost revenue from the new normal space arrangement.

- Better marketing and promotion

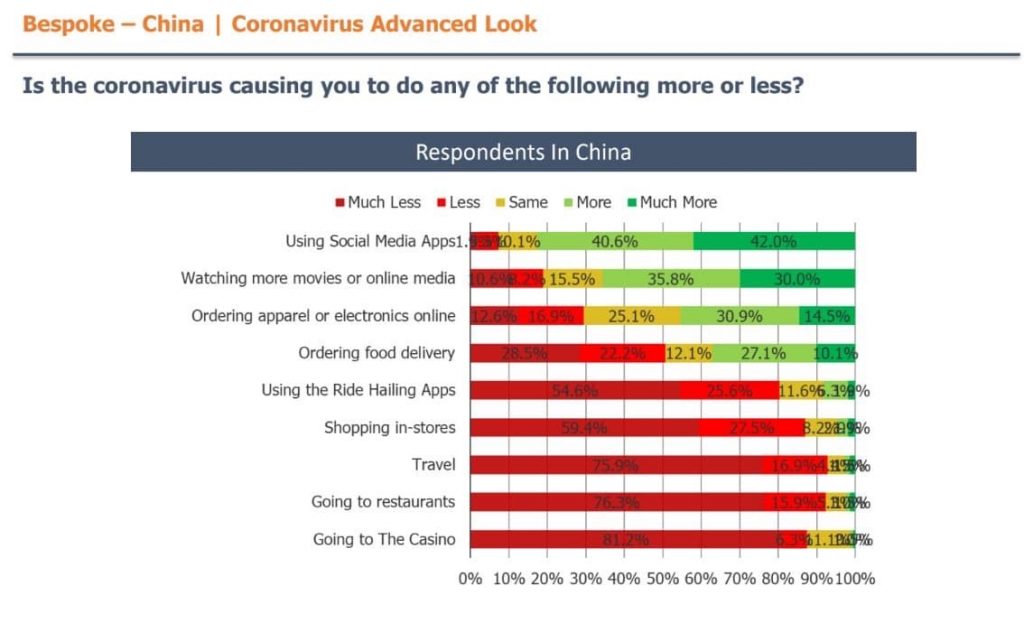

I have a strong opinion that GMs should not stop marketing especially media marketing for the China market now even it is a financially challenging time. At the time of writing, China is normalising and domestic travel is resuming gradually. In fact, Chinese are spending more time on social media during COVID-19 and hotels will be missing a good opportunity if they stop their online branding and marketing efforts now. I have expressed my opinion in the interview with Campaign Asia-Pacific. Reference: https://www.campaignasia.com/article/travel-marketing-under-covid-19-is-there-any-point/459223

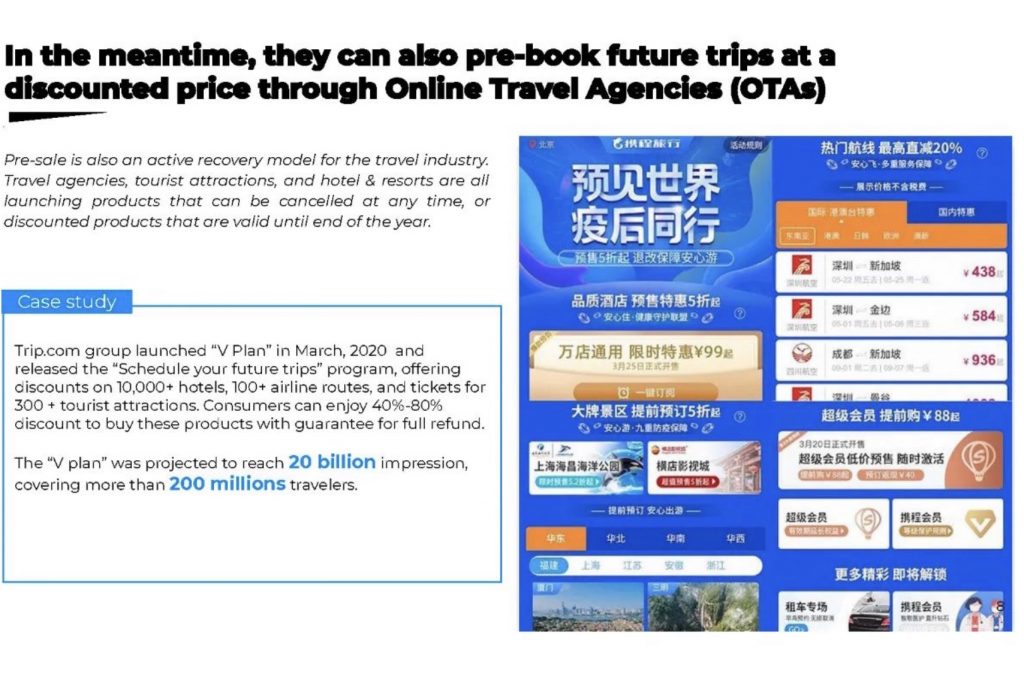

For hotels in general, engage with OTAs now. I have shown to the audience at the webinar that Ctrip launched the V Plan, “Schedule your future trips” program offering discounts on tens of thousands of hotels, airline tickets and tourists attractions tickets at 40-80% discount with guarantee for full refund. Yes, these are mostly for domestic travel first but I will not doubt Ctrip will launch more international offers soon.

At the end of the day, there are still 10,000+ hotels that offer discount via Ctrip. Why will Chinese pick you rather than the hotel next door? Other than price, as we do not recommend a blanket discount strategy, it really goes back to getting your hotel top of the mind of Chinese travelers. Whoever can do better marketing and promotion will achieve faster recovery.

In closing, Carnival Corp’s Chief Executive Officer just said China might be among the first areas where cruise lines start sailing again as the coronavirus pandemic eases. If a cruise company can be optimistic about the China market to be among the first to rebound, I think we can be as positive as well.

Tags: Post COVID-19 trends; Hotel Management; Hotel GM; Hospitality Marketing; Recovery Timeline; Tourism Rebound; Chinese Outbound Tourism; China Marketing; Chinese Tourists

Compass Edge is a company offering online solutions to independent hotels. It is a niche service provider offering cost-effective branding solutions for overseas hotels to establish an online presence for the booming Chinese FIT market. It can also provide customers with an Internet Booking Engine, meta-search integration, GDS distribution and Channel Manager in its portfolio of solutions.

This article was written by Anita Chan, CEO of Compass Edge. Anita has extensive travel industry experience, and has worked all over the world with leading companies such as Four Seasons Hotels and Delta Hotels, as well as in corporate offices and technology service providers. Before joining Compass Edge, Anita worked as Regional Director for a leading OTA in Asia, as Global VP for a leading digital agency, and as VP Asia Pacific for Small Luxury Hotels of the World.